It's a terrible sensation to grab your wallet only to discover nothing. Whether lost or stolen, you no longer have access to your money, credit cards, identity, and anything else you may have had. To add insult to injury, identity theft and credit card fraud can follow closely on the heels of a lost wallet. According to research by the Department of Justice, twenty percent of victims of identity theft who have any idea how their information was obtained attribute it to a lost or stolen wallet or checkbook. However, according to Paige Schaffer, president and chief operating officer of General Global Assistance's Global Identity & Digital Protection Services, you can take precautions to lessen the blow if and when your wallet is stolen. Here are some tips she says are worth remembering.

Here Are 5 Tips On What You Should Do If You Lose Your Wallet

Contact Your Bank

Since the funds on ATM and debit cards come directly from your checking or savings account, you should immediately report their loss to your financial institution. The bank may request that you evaluate your account activity from the past few days to ensure that you made the transactions. The bank will then place a fraud alert on your account. The bank will freeze your cards, so you can't use them. The liability for fraudulent charges on lost or stolen debit cards is higher than that on stolen credit cards, and it varies depending on how promptly the bank is alerted. This step should not require visiting a physical bank location. The specifics vary by the financial institution.

Get In Touch With Your Credit Card Companies

It is not uncommon for identity thieves to utilize stolen credit cards for fraudulent purchases. Most credit card issuers are aware of this, so keep an eye out for any suspicious activity and inform you if necessary. Further, you cannot be held accountable for fraudulent activities, according to the FCBA. However, preventing illegal charges is preferable to challenging them after they have already been made. As soon as you hang up with your central bank, you should call the other companies to report that your cards have been taken. 4 You could be held responsible for any charges above $50 made with your credit card before you report it lost or stolen. The FCBA ensures that you won't have to pay more than that.

Report To The Police

Local law enforcement's efforts to recover stolen property are typically futile. You may not be a high priority unless there were other victims or the criminal looted a bank (as opposed to stealthily taking your wallet). You should still submit a police complaint so that you have documentation of the happened. 5 Creating a paper trail in this way can aid in the recovery process. Contact the local police station with jurisdiction over the area where you last saw your wallet or pocketbook to make a report. Contact the police station that serves your area if you are unsure of the precise location. It's also possible to submit the report electronically.

Send A Fraud Alert Request

Get in touch with Experian, Equifax, or TransUnion and request a fraud alert be added to your credit report. Thanks to this alert, financial institutions will now perform further checks to ensure your identity is not compromised before extending your credit or making any changes to your existing accounts.

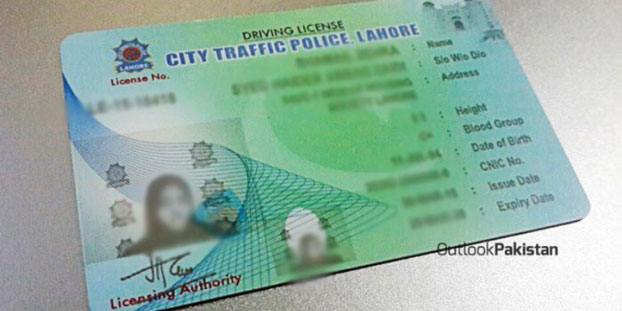

Get A New License To Drive

A driver's license cannot be replaced online in most states. You'll have to visit a Department of Motor Vehicles office and provide identifying information like your Social Security card or a birth certificate. A police report, FTC report, or other proof of theft may be required if you can't produce the necessary identity or if it was stolen with your other forms of ID.

Conclusion

Most of the time, our wallet is the most flexible thing we carry. It stores our cash, credit/debit cards, IDs, apartment keys, and possibly other paperwork. It doesn't matter if you're a frequent reader of the Prosper blog or just typed "lost wallet" into Google and landed on our site; we're here to help. Having your passport or wallet stolen is a major hassle, but you may avoid it by taking precautions ahead of time. Preparation can lessen the blow of a lost or stolen wallet, whether you're far from home or just around the corner.